If you've been thinking about buying a car this year, stop thinking. Autofestival is happening RIGHT NOW – started January 24, ends this Sunday February 2.

That's 3 days left.

But here's the part most people miss: while the festival itself ends Sunday, the bank financing deals run until the end of February. Which means you still have time to make a smart decision instead of a rushed one.

What Is Autofestival and Why Does It Matter?

For 62 years, Luxembourg's entire car industry has concentrated into 10 days every January. This year's edition runs from January 24 to February 2, 2026, with 90 dealerships opening their 170 showrooms across the country.

The numbers tell you why this matters: dealers generate up to 35% of their annual turnover during Autofestival and the following two months. That's not marketing hype – that's actual industry data from Fedamo, the car dealers federation.

When a third of annual sales happens in two months, dealers are motivated. Inventory is stocked. And most importantly for you, banks offer their best financing rates of the year.

The Real Opportunity: It's Not About the Festival, It's About the Financing

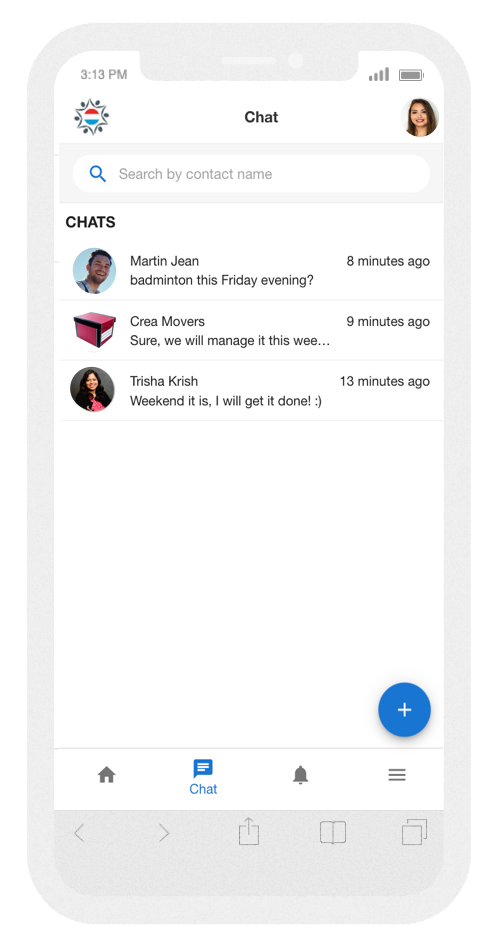

Everyone focuses on the Autofestival weekend. The crowds. The balloons. The test drives.

But the actual financial opportunity extends beyond Sunday.

Banks like BIL are offering promotional car loan rates until February 28. That's 4 full weeks after the festival ends.

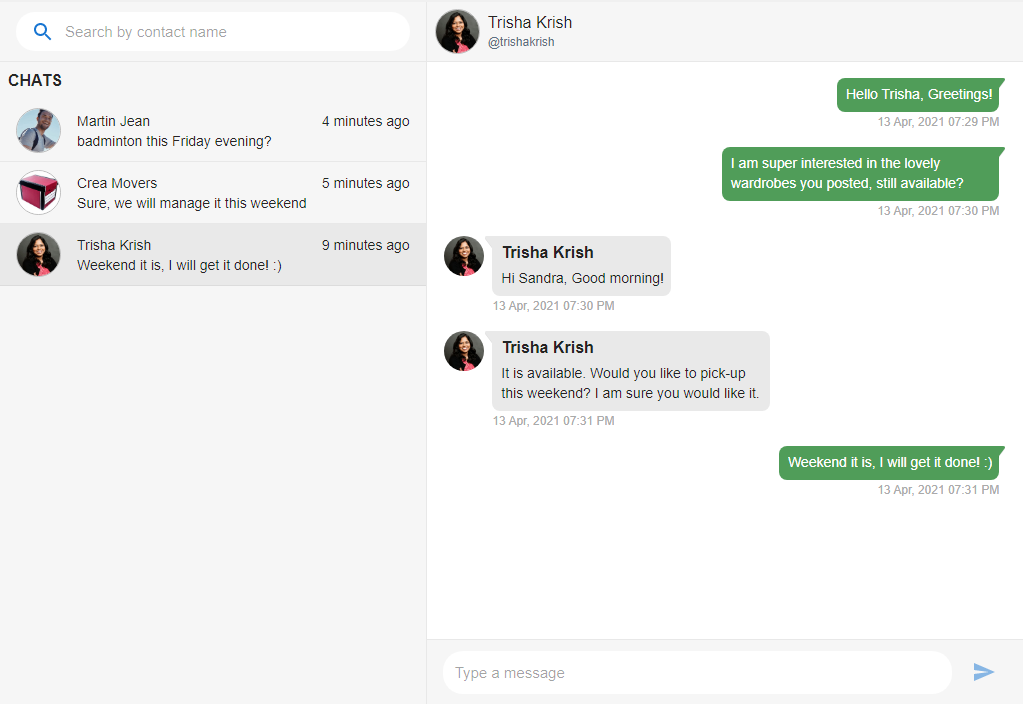

BIL's current offer:

4.35% fixed rate

Zero processing fees through Feb 28 (for young people under 28)

Enhanced rates for buyers under 30

Quick calculator that doesn't require your phone number

Check what your monthly payment would be: bil.com/static/autofestival/index-en.html?utm_source=Luxexpats&utm_campaign=Autofestival

The calculator takes 2 minutes. You put in the car price and loan term. It shows you the actual monthly cost. That's it. No commitment, no callback unless you want one.

The Smart Play: Visit During the Festival, Buy After

Here's what nobody tells you.

This weekend (January 31-February 2) will be packed. Dealerships are open on both Sundays (January 25 and February 1), which normally never happens in Luxembourg. Test drives are booked solid. Salespeople are juggling multiple customers.

The smart move: go this weekend to look, test drive, and narrow down your choices. Then come back next week when it's quiet to actually negotiate and buy.

The financing rates are identical whether you buy on February 1 or February 25. But your leverage and the salesperson's attention are much better when you're not competing with 50 other people.

What's Actually Different About Car Buying in 2026

In 2025, electric vehicles and plug-in hybrids together accounted for 34.7% of new car registrations in Luxembourg – more than one in three new cars. Hybrids specifically rose from 4.1% in 2019 to 29.3% in 2025.

This isn't theoretical. Walk into any showroom and half the floor space is electric or hybrid.

The government still offers incentives:

Up to €6,000 for new electric vehicles

€1,500 for used electric vehicles (introduced in 2024)

Must keep the vehicle for 36 months (changed from 12 months in October 2024)

But here's the catch: the growth rate of fully electric vehicles is leveling off. After years of explosive growth, the market is stabilizing. Electric vehicles dropped slightly from 27.4% of new registrations in 2024 to 26.9% in 2025.

Why? Uncertain economic climate, tax conditions, and constraints around CO2 calculations, according to Fedamo.

Translation: if you were waiting for electric cars to get cheaper or better, that moment is now. They're not getting dramatically better or cheaper next year. This is the market.

The Financing Math: What You'll Actually Pay

Let's stop with vague percentages and talk real numbers.

Example 1: €20,000 used car

BIL rate (4.35%) over 60 months

Monthly payment: ~€371.5

Processing fees: €0 (waived until Feb 28 for people under 28)

Example 2: €30,000 new hybrid

BIL rate (4.35%) over 60 months

Monthly payment: ~€557.25

Processing fees: €0 (waived until Feb 28 for people under 28)

After the auto festival exclusiveness, rates go back to standard rates.

For simulating yourself, click this link:

bil.com/static/autofestival/index-en.html?utm_source=Luxexpats&utm_campaign=Autofestival

Luxembourg’s Car Loan Tax Advantage (That Many Expats Miss)

Luxembourg allows taxpayers to deduct car loan interest from their taxable income, up to €672 per person per year, under the “special expenses” category.

This deduction category also includes certain insurance premiums (such as car and home insurance), which means the €672 cap applies to the total of all these expenses combined. You cannot stack unlimited deductions—but many expats do not fully use this allowance.

Example impact over time

Maximum deductible amount: €672 per year

Over a 5-year car loan: up to €3,360 in deductible interest

At a typical marginal tax rate of 25–35%, this can translate into approximately

€800–€1,200 in real tax savings (and potentially more for higher earners or dual-income households)

What About Used Cars?

Autofestival primarily features new vehicles, but used car sections exist at most dealerships.

The financing works the same. BIL's 4.35% rate applies to both new and used.

The Environmental Shift Is Real

Average CO2 emissions from newly registered vehicles dropped 7.7% in 2024 to 99.3g/km – a 38.2% decrease over six years.

By comparison, Germany discontinued EV subsidies and saw emissions increase by 4.2%.

Luxembourg's approach is working. The car fleet is genuinely getting cleaner.

Diesel vehicles dropped from 41.9% of new registrations in 2019 to just 9.9% in 2025. They're becoming niche.

If you're buying a diesel in 2026, you should have a specific reason (long-distance driving, towing, etc.). It's no longer the default.

Who Should Actually Buy During This Period

Buy now if:

You were planning to get a car in 2026 anyway

Your current car is dying or already dead

You've done your research and know what you want

The monthly payment fits comfortably in your budget

You work, study, or get a pension in Luxembourg (qualification requirement)

The Next 72 Hours: What to Do

Friday, January 31 (Today):

Make a shortlist of 3-5 models you're interested in

Check BIL's calculator to see what monthly payments would be: bil.com/static/autofestival/index-en.html?utm_source=Luxexpats&utm_campaign=Autofestival

Book test drives for Saturday (call ahead, slots fill up)

Saturday, February 1:

Visit dealerships, test drive, ask questions

Take notes on exact prices and options

Don't feel pressured to buy today

Remember: dealerships are also open Sunday and financing continues all month

Sunday, February 2:

Last day of Autofestival

If you found what you want and the numbers work, move forward

If you need more time, that's fine – BIL's rates continue until Feb 28

Monday, February 3 - Friday, February 28:

Dealerships back to normal hours and pace

Same financing rates, quieter environment

Better time for actual negotiation

Use the calculator, compare offers, decide

Try it: bil.com/static/autofestival/index-en.html?utm_source=Luxexpats&utm_campaign=Autofestival

Takes literally 2 minutes and you'll know exactly what you'd pay monthly.

What Happens After February 28

Life goes on. Car dealerships don't close. Banks still offer loans at standard rates.

But:

Processing fees come back for young people as well

Rates return to standard levels (>5%)

Promotional young adult rates disappear

Dealer motivation decreases

About BIL's car loan: Available until February 28, 2026. Requires economic link to Luxembourg (employment, studies, or pension). Rate and terms subject to credit approval. Full details at bil.com. This article explains available options but is not financial advice.

Quick Links:

BIL Car Loan Calculator: bil.com/static/autofestival/index-en.html?utm_source=Luxexpats&utm_campaign=Autofestival

Fedamo (Participating Dealerships): fedamo.lu

SNCA (Vehicle Registration): snca.lu

Luxembourg EV Subsidies: guichet.lu/en/citoyens/transports-mobilite/achat-location-vehicule/aide-achat-vehicule